Are you fed up with getting surprises? Problems appear suddenly or projects that you thought were going well suddenly are not. Or great opportunities drift by without you being able to capitalise because you just can’t seem to get everyone ready in time.

This can be frustrating at best, career limiting or at worst devastating for a business over time. There are only so many finger tip saves you can do before one goes in.

If this is happening regularly are you probably missing your targets. And what does that mean for you, your team or your business?

Business can change these outcomes for the better.

What could you do if you spent less time firefighting? How would that impact the stress levels and confidence of your team and business? If you had more time, what would you do with it?

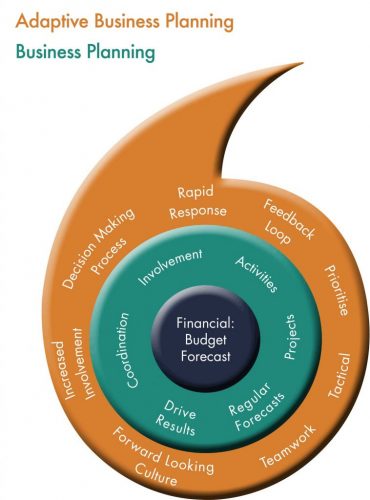

If you spent more time looking forward rather than looking backwards; at the activities, the projects and the financial results, you would be able to positively impact more of the opportunities and problems you face.

You team would be happier, feel more in control and have less fires to put out. You would have less silos and activities and projects would be better co-ordinated. The bigger or more complex your business, the more you have to gain.

Interested?

Business Planning will provide you visibility, rigour, adaptability, teamwork and results. Business Planning is a process and discipline. We appreciate that these words may be unappealing, especially for those of you who favour more last minute, reactive, free flowing and creative approaches. Business planning is not perceived to be exciting. Business Planning does provide results, really good results. Just look at any successful business.

Business planning is not:

- Writing a document which then gathers dust and is not used by anyone.

- A financial “budget” which sets financial targets everyone is expected to meet without further help

- A magic wand. [Work and a change of operating model is needed for success]

What Business Planning gives you Get more from your planning process

Two different levels of Business Planning:

Why Emerson Nash

- Exceptional business experience in depth, breadth and quality

- Results focused. Projects = £100k+ in value and 3x or more ROI

- Up to 100% refund – via introductions to other business leaders

- Partnership – we treat your business as we would our own

- Very strong people skills

- Decades of line management experience in top businesses

- Hands on implementors – we get things done

- We only employ experienced experts (no “juniors”)

- Easy to work with – we listen and do what we say