18 Actions to Improve Cash Flow Management

Cash flow management in a time of crisis is vital for business survival. We are going to take you through 18 actions within 4 broad cash preservation strategies. Most of these actions are within your control.

You should be thinking about implementing some, or all these actions, if you have not already done so. A lot of these actions may seem obvious to many of you. We really want to emphasise the importance of acting quickly and implementing the cash flow management actions you take really well.

The overall team and business discipline makes a big difference to the effectiveness of your actions over time on your cash balance.

First Strategy: Control the cash you have

Action 1 – Run your cash flow forecasts NOW.

Keep running your cash flow forecasts each day or week depending on how close you are to running out of cash. If the business runs out of cash, it fails.

The reason you run your cash flow forecasts is to create forward visibility of your likely cash balances. This gives you time to overcome problems. Cash flow forecasts are a critical step in cash flow management.

We suggest your cash flow forecast has the inflows and outflows of cash shown each week or, if cash is very tight, each day. Running them on a monthly basis is not detailed enough. Your cash may drop and then come up again within a month or even a week. This weekly or daily level of detail should be maintained for three months into the future.

Then you can reduce the level of detail for the following three to nine months. This provides you a good picture of the cash level in your business for at least the next six months. You need this amount of time to act. Think how long it takes to apply for a bank loan.

Action 2 – Authorise all spend prior to committing to that spend

This action aims to ensure that you control the cash spend that will happen in the future. You can check the cash outflows are in line with your cashflow forecast.

A Purchase Ordering (PO) System typically delivers this action. If you have a PO system, then make sure that you are using it well. If you do not have a PO system, then there is a lot you can do with an Excel spreadsheet and issuing sequential numbers to suppliers.

The key is to communicate with suppliers, in advance and often, that you will not pay any invoices without a valid PO number. Then send back any invoices you receive without a valid PO number and do not pay them. This discipline is vital for this action to work effectively.

Action 3 – Reduce the ability of employees to spend money on the company’s behalf

This allows you to reduce the spend and control it centrally and in line with your cash flow forecast. An example would be to reduce the credit card limits or remove credit cards from your employees. Think of all the other ways employees might spend on your behalf.

Action 4 – Reduce employee spending authority levels

An extension of Action 3. If your Marketing Manager has the authority to spend say £5,000 on a marketing campaign without any further sign off, then reduce this level, say £1,000 or £500. This stops employees committing to significant spend on the company’s behalf.

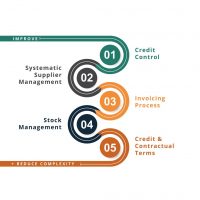

Second Strategy: Get more cash in from normal trading

Action 5 – Focus on Credit Control

Get as much money in from your customers as quickly as possible. It is really important to pick up the phone to build and maintain good relationships. People pay people they like, in preference to those they don’t like. So be nice, be professional and be very persistent. Every time you speak to someone ask:

- Has the invoice been authorised?

- Is the invoice in a payment run?

- What date is the payment run?

Remember, pick up the phone and be persistent. This is one of the most important actions for good cash flow management.

Action 6 – Get your invoices right first time

Do not give your customers any excuse to delay paying. Make sure that you have all the information they need to pay your invoice quickly and make sure there are no mistakes on the invoice. This reduces delays.

Action 7 – Deal with any invoice queries quickly

Queries will delay customer payments. Make sure you deal with any issues very quickly. This will reduce the customer incentive to raise queries and improve your brand/reputation.

Action 8 – Sell as much stock as possible

You have invested cash into your stock. If you are running low on cash, selling this stock for a price higher than the cash cost of purchasing this stock will release cash while limiting the extent of losses.

We appreciate that this action is hard to do, particularly if demand has fallen. Get creative and work hard at reducing the stock you can to release cash.

Action 9 – Delay payments to suppliers

When you run low on cash, this is an easy option to implement. (Note that this option is not without consequence!). We suggest you categorise your suppliers into

- Very important – those critical to your business

- Important – those hard to replace

- Commodity – those easy to swap or replace

Treat each category differently. Spend time looking after those that are more important – which may not mean paying them quicker. The very important suppliers often have the largest balance with you.

Delaying supplier payments is the quickest action you can take to improve your cash flow.

Action 10 – communicate lots with your suppliers

Suppliers want to know they will get paid. Pick up the phone and tell them what you are doing and why.

This should provide confidence to the suppliers that they will get paid, they know what is going on and this action maintains your supplier’s trust. Compare what might happen if you go silent. You will certainly get a lot more phone calls from worried suppliers!

Suppliers will remember how you treated them when the recovery comes.

Third Strategy: Get in more cash from elsewhere

Action 11 – Apply for all government help

Apply for all applicable sources of government help.

- Grants

- Coronavirus Business Interruption Loan Scheme (CBILS)

- Speak to HMRC about delaying VAT and access Time to Pay

- Delay rate payments if possible

- And furlough any staff that you not utilising fully.

Action 12 – Speak to your Bank

Banks are an important source of funding. Your cashflow forecast and the list of actions and projects you are undertaking to manage your cash are also really important to have before you approach your bank.

Banks tend to lend to those business that have done their homework, have thought through the issues, and come up with solutions. These should hopefully all feed through to a cashflow forecast that is realistic, and shows the business getting through a tough patch and generating cash again. Remember, banks want to know they will get their money back. Typical types of funding:

- Term loans

- Invoice financing

- Overdrafts

Action 13 – Speak to Investors

If you have third party investors, speak to them about additional cash. These investors have a strong vested interest to make sure you survive and prosper. Ask for loans, undertake a rights issue, or cash call. Current investors can be a very good source of funding.

Speaking to new investors is likely be a lot less appealing. Current valuations are low, and therefore, new funding will come with heavier dilution in a crisis. New investors are still an important source of funding.

Fourth Strategy: Reduce and/or control the cash going out

There are many areas that we could discuss here. Look at all your costs and try to reduce them without hurting your business. We are going to concentrate on staffing costs specifically and will assume that you have furloughed any staff you are able to. Our aim with the following points is to reduce costs and keep staff available for the recovery when it comes.

Action 14 – Stop hiring

Simple. Most will do this early in any crisis. If you have lots of employees, make sure this is actioned across the business effectively. Introduce a sign-off process that is managed at a senior level. This reduces/stops hiring but keeps a mechanism for those essential hires.

Action 15 – Reduce employee’s salaries

Reduce salaries across all staff. Think what a 25% reduction would do for your business. Or whatever is needed. You will need to consult staff and follow a legally correct approach. As soon as a recovery starts, think about re-instating the original salary levels or you may start to lose staff. This approach is good when all businesses are in a similar situation.

Action 16 – Reduce working hours

Think about reducing working hours across all staff or groups of staff. This is particularly good when demand falls, and everyone is not as busy. E.g. reducing working days from 5 days to 3 days would have a positive impact on costs. Again, you will need to consult staff and follow a legally correct approach to do this.

Action 17 – Offer sabbaticals or other forms of unpaid leave

This reduces the number of active staff working for you and therefore the costs. While this will not appeal to most, some may find it attractive. E.g. working parents that need to home school

Use any combination of Actions 15-17 to achieve the result you need.

Action 18 – Make staff redundant

If your other actions have not reduced costs and cash outflows enough, then consider making staff redundant. This permanently reduces staff numbers and costs. Make sure that you calculate the short-term costs of making any staff redundant. You will need to pay out (cash outflows) before you receive the benefits of reduced costs.

Summary

The above 18 actions will improve your cash balance and are all useful tools in cash flow management. Remember that how you implement the actions is really important to get the best benefit.

If you only take one action away, please run your cash flow forecasts in detail and start planning how you are going to overcome your cash shortages.

About the Author

Jess Coles is CEO of Emerson Nash, a consultancy specialising in Business Performance Management. Jess is a Chartered Accountant and a Corporate Treasurer. He has held several CFO roles in companies ranging from sales of £20m to £200m.

Jess has successfully managed several companies experiencing cashflow problems:

- 2008 downturn

- A business in a CVA process

- A turnaround of a business about to fail

- A business, surviving through a shareholder injection of cash

If you would like to talk to Jess, please call on 0203 500 1200.

Download our Guide to improve your cash:

6 Must Do Steps to Increase Cash

Help to Find Hidden Cash in Your Business:

Release additional cash quickly