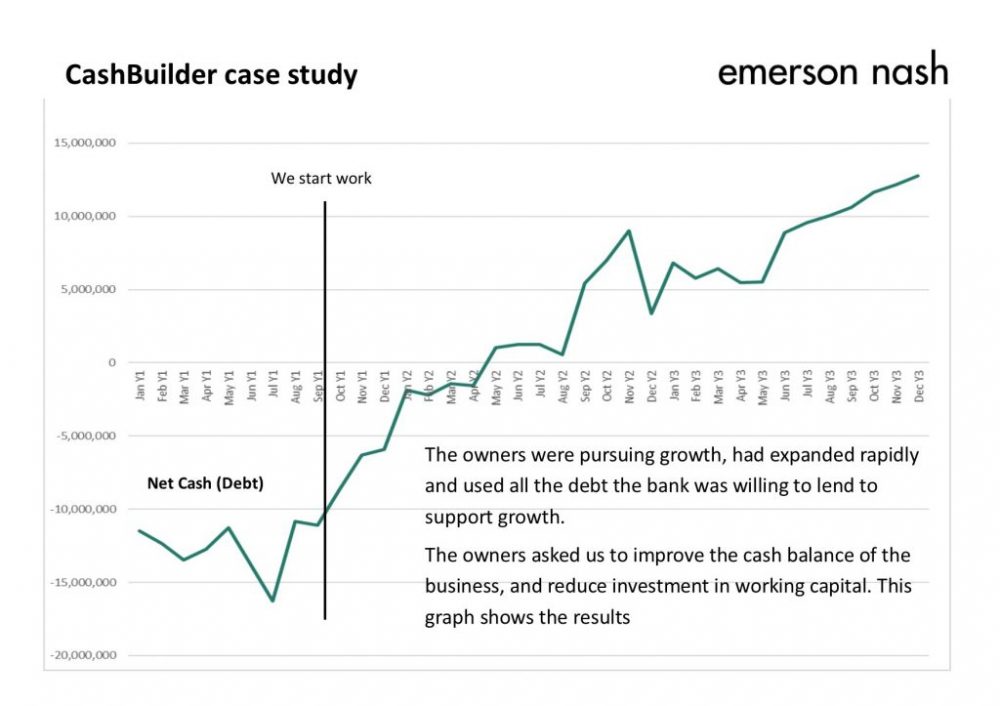

£24m Cash Generated CashBuilder Case Study

THE SITUATION

The business was close to failure after winning several large low margin contracts. This combined with an outdated business model relating to supplier management and poor customer debt management, left the business on the brink of failure.

The business had one days’ worth of supplier payments in cash on our first day. The bank had refused to lend it any more funds.

THE PURPOSE OF THE PROJECT

To generate cash quickly to save the company, and then change the business model in regard to working capital management to generate more cash for the business in the longer term.

OUR PROJECT

Jess (Emerson Nash) worked with the client team for over 24 months. We had to change not only the day to day practices but also management and the sales team’s approach and attitude to credit provided to customers and how suppliers were paid. We

- Persuaded the management team to change their approach to supplier payment and implemented this is small steps to prove that it would not impact the business.

- Extended the payment terms to suppliers by a week, generating cash in the short term. The payment terms enjoyed by suppliers were still better than nearly all competitor companies.

- Created a consistent companywide focus on credit control to ensure we were paid to the terms agreed with our customers.

- Improved our invoicing processes to reduce errors and followed up immediately on any invoice queries. This reduced invoice queries to sector leading levels (per top ten accountancy firm).

- Invested in processes, visibility and accountability through each stage of the working capital cycle to embed these practices.

THE OUTCOME

We generated £24m in cash in 24 months as shown in the graph. The £12m bank financing facility was paid off. Most of this additional cash was generated through better working capital management, with some relating to profit.

The owner, the management team and the bank manager were all sleeping a lot easier at night. The change in the cash position moved the company from fighting for survival to having a large range of options for investment to grow the business.

The increase in staff morale and positive energy in the business was notable.

RETURN ON INVESTMENT (ROI)

|

|

Value created |

Return multiple |

|

Return over 1 year |

£24,000,000 |

Over 10 times |

|

Return over 3 years |

£24,000,000 |

Over 10 times |

We measure the return on investment as the ratio of what value the client receives compared to their investment with us.

Improving working capital management leads to a one-off cash benefit.

About the Business

-

International business

-

Multiple large contracts to provide services in a variety of international countries

-

A wide range of customers from blue chip corporates to mid-sized business

-

Sales of circa £130m and Profits After Tax of below £1.5m per year