Financial Reporting: Why measuring business success is vital

In business, financial reporting is the way of keeping score, of measuring business success. Non-financial reporting is and should also be used.

So why do we use financial reporting? The majority of business employees have not been trained on what financial reporting means or how to use it. It is no surprise that many people do not look at it nor know how to use it due to lack of knowledge. “Financial reporting is for the bean counters to do, not me”.

Keeping Score

We have ways of keeping score in so many aspects of our modern-day life. At school we have tests and course work marked by the teacher and school league tables. In every sport there is some form of scoring and gamification. Sport success is measured against the clock or beating competitors. In university and professional training, there are pass and fail marks, grades to show the level of achievement or knowledge gained.

These grades are important – get good ones, you offered better jobs, higher pay; get lower grades, doors close rather than open.

In business, it is no different. Financial reporting is the grading measure. When you earn lots of profit, your business is judged as successful. Low or no profits, you are unlikely to survive.

Business complexity

Businesses are complex. The range of different business services and products is vast. Companies house has 4.2 million business registered in 2019

The 4.2m businesses have many similarities. People own and run these businesses, make decisions, get things right or wrong, produce something valuable to others.

Each of these businesses is also very different. Different people run each business, with different ideas, different approaches, different outcomes. How they provide products and/or services are all slightly different.

Therefore, it is hardly surprising that measuring the success of businesses against each other is no easy task. Financial reporting tackles this challenge. Through common rules, we can compare the performance and success of different business and judge which are better or worse.

Pretty important if you are going to lend to the business, invest in the business or supply to that business.

The distance of decision maker to coal face

As businesses grow in size, they generally become more complex. Complexity comes with more staff, new products/services, new offices, and new markets or channels. In most businesses with growth, the key decision makers (directors and senior managers) are further and further removed from the coal face. Directors find it harder to know what really is going on. How do you know what is happening in your French office if you are sitting in London?

Biased Information

Another challenge for business leaders is getting accurate, unbiased information. We are not suggesting that employees intentionally create inaccuracies or bias. Firstly, we all have events, emotions and perceptions formed from past experiences that influence how we think and feel. The human brain is efficient in the use of energy and therefore applies learned patterns to current situations. Very useful if a predator jumps out of a bush in the jungle but it does have its downsides – it colours our perception of reality.

Don’t tell managers bad news

Secondly, our line managers hold the keys to our career progression (or not). Therefore, we are all careful of what we pass onto our managers. Research has proven that we give a healthy “positive news” bias at work. As a leader, you loudly get told all the good news, but less so the bad news. This goes up the chain, being “coloured” at each level.

So, the longer the distance between key decision maker and the coal face, the greater the reality distortion in the information being passed along the chain. Decisions are made using this information. If the information does not reflect reality, how will the decision be a good one! Poor information relates directly to three of the top 8 reasons why businesses fail (per Hiscox).

A very effective way to counter this bias is to use factual information and financial reporting. Financial reporting and other forms of reporting within a business is very important to keep reality central to discussions and decision making.

Measuring business performance

Financial reporting is the business measurement language. If you do not understand this language, then you are missing out on a wealth of information. You do not need to be an accountant or a financial expert to learn a lot from a profit and loss for report for instance. Ask your finance team to produce a profit and loss report for your area of responsibility, and then learn what it is telling you. Get help as needed.

Having access to this widely used information (each company has financial information) and then using it to better understand exactly what is happening within a business will make a difference to decisions you make and this leads to better performance (assuming you take the right actions). You do more of what you can prove works and less of what doesn’t.

If you are a team member or manager, better performance leads to promotions, to increased social status, higher salary, more challenge, development … you get the picture. I would argue that it is in everyone’s interest to learn some of this financial language.

If you are a business owner or leader, the better performance leads to opportunities to grow the business, increases business resilience, status and so on. Running a business is a competitive pursuit, and good financial information gives you an advantage. If you don’t take advantage of opportunities, competitors will. Your choice.

The more people in your business able to use financial information, the better your team performance is likely to become. This assumes the information is used to do more of what works and less of what does not. Everyone wins.

Why is financial information important?

Everything and we mean everything you do within a business impacts on financial results. Every action, activity or project you undertake. That is why financial information is so valuable.

For instance, hire a new salesperson, you add cost and reduce your profit. If this salesperson performs well, the sales they add and one hopes the gross profit generated is greater than their costs, resulting in higher overall profit. If they don’t perform, you may have lost out.

Improve the efficiency of a production process, you produce more units for the same operator and machine time spent, which translates into greater profit.

You need revenue to generate profit. And profit to generate cash. Net profit produced and cash generated are two favourite measures of successful businesses, used by managers and investors the world over. Always remember that these measures are the outcomes from activities and projects you undertake in the business. Improve the activities, improve the profit and cash generated.

Financial Information – what gets measured gets managed

Getting good quality financial information takes time, investment and resources. We suggest this is nearly always a good investment, if done in proportion to your business complexity.

So, what information should you produce?

This is one of the most important questions to answer BEFORE you undertake significant investment of time or money. In our experience, most business have too much data overall, but too little focus on what makes a real difference to that business.

What the management team focuses on, everyone else does too

Whatever measures you chose will drive behaviour within your business. Is the behaviour your reporting creates, the behaviour you want? What the management team focuses on is what everyone else does too.

An example: A very sales orientated company produced a huge amount of data on performance by salesperson, customer, channel, market etc. This business grew its top line consistently year in year out. Great. It had very limited focus and reporting on profitability and as a result had low profitability. In fact, to double its profit (from a low base), it would have to more than double its current revenue – a 10-year undertaking! It was much easier to increase profit 10x by undertaking a different approach and focusing on the drivers of profit, than to double revenue.

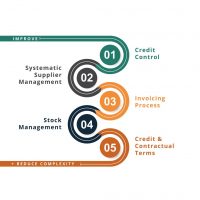

Find your key operational and financial drivers

We suggest that you spend time as a team working out your key operational and financial drivers. For instance, if the number of sales meetings is a critical driver of revenue, focus on this rather than phone calls.

Think about the chain of activity and projects that your company does to produce value for your customers. Ideally, you want measures all the way along the chain. If things go right or wrong, then this provides are lots of opportunities to spot this before it finally hits the financial information. Financial information is the last indicator to be produced. A simple example:

- You take an order from a customer

- You order the product from your supplier

- It is delivered to you and you ship it onto your customer

- Then the financial impact is seen in the P&L, days, week or even months after the order is placed. Do you want to wait this long to know what is happening?

Think very carefully about what you are going to focus on and consequently report on. Useful information supports decision making.

Why measuring business success is vital

Everyone has an opinion. Opinions are based on our experience, our emotions and the patterns we recognise.

Measurement, when done well, presents facts. Using facts as well as opinions to run a business will nearly always outperform a business that use just opinions. The bigger the business, the more useful measurement and facts are for the key decision makers.

We all make decisions emotionally and then hope the facts align or justify with facts. The more we can use facts and reality to influence our decisions, the better the business outcomes are likely to be.

In summary

Information is power. The power to increase your, your team’s and company’s performance. Financial reporting and financial information are the languages of business performance measurement. It is here to stay. The better your knowledge, and that of your team, of financial language, the more equipped you all will be to make good decisions, and drive improvements in business performance.

If you want better business success, good financial reporting has a vital part to play.

About the Author

Jess Coles is CEO of Emerson Nash, a consultancy specialising in Business Performance Management for product-based businesses. Jess and the team had designed and implemented data infrastructures, operational and financial reporting for the purpose of creating visibility and improving decision making in many businesses, nation and international.

Call us on 0203 500 1200 to discuss any questions or informational challenges you may have

Download our Guide to improve your cash:

6 Must Do Steps to Increase Cash

Help to Find Hidden Cash in Your Business:

Release additional cash quickly