In partnership with you, we’ll help you manage, grow and improve your business over a 2 – 5 year period. We are a true partner, and will bring the following to your business:

- business & investor knowledge and experience

- an analytical and people based skill set

- a track record in execution – getting things done

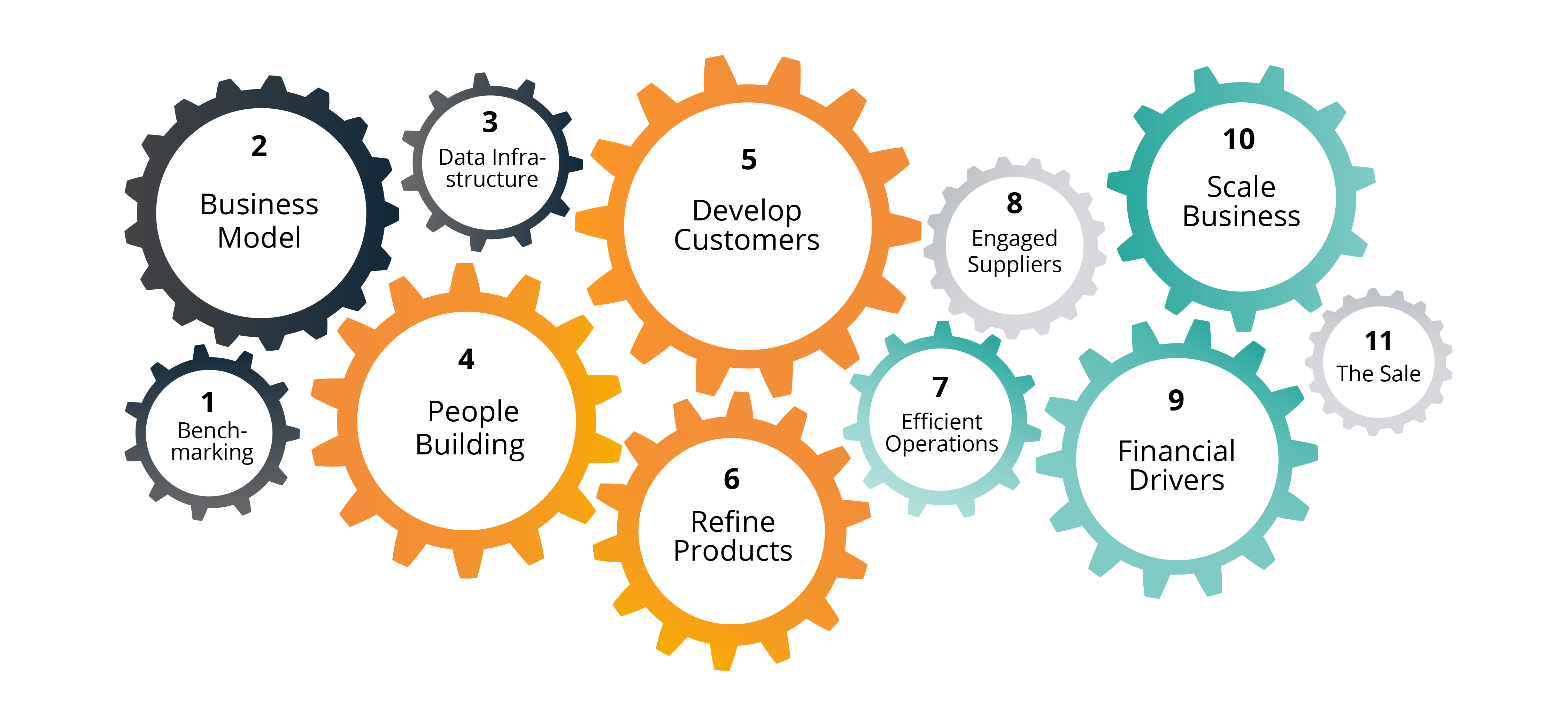

We work with you in all the areas shown in the cog info graphic below. The financial impact of this work is measured in increases in future cash flows and business valuation.

For business owners looking to significantly improve performance and increase the valuation of their business by at least £1m for:

- An exit event

- Increasing future dividend payments

- An increase the capability, strength and resilience of your business

- A transition from being a business manager to an active shareholder

If we are unable to increase the value of your business by at least £1m over the agreed time-frame, any fees paid by you to us will be returned in full. See more about our ValueBuilder guarantee here.