£5m+ profit improvement ProfitBuilder Case Study

THE SITUATION

The business operated a large contract in a country with a very lose set of regulations and laws. The contract contributed around £18m or 14% of revenues for the business. The management team were not sure about all the costs of operating in this country. It was difficult to understand how to find out and get resolution with the authorities around the tax costs relating to the contract. The management team had not started this work.

Only withholding tax had been paid. The other applicable taxes had not yet been calculated. This was a similar position to many companies working within this country. The contract had already been running for over 4 years.

The Purpose of the project

To understand the cost base and tax requirements of the contract, with a view to maximising profitability from this contract.

The project

The work that we undertook with the management team included:

- Reviewed the contractual terms and tax positions with third party lawyers and in country tax advisors

- Meticulously analysed and documented all the income and expense items over several years, relating to over 100 sub-contractors

- With third party advisors, checked the income and expense against the original contracts (customer and sub-contractors) and the applicable tax laws the country.

- Restructured the sub-contractors’ contracts to take advantage of multiple incentive allowances offered within this country. This included contacting each subcontractor.

- Calculated and modelled the likely tax bill based on various scenarios

- Engaged with the local tax authorities via in-country third party tax advisors, to negotiate the tax bill relating to prior years and the current year.

- Cleared the backlog of taxes with the help of third-party tax advisors.

- Arranging payment to the correct person and department was difficult. Corruption was a real risk.

This project removed a key uncertainty over the business, providing clarity on tax liabilities which were measured in £millions.

The outcomes

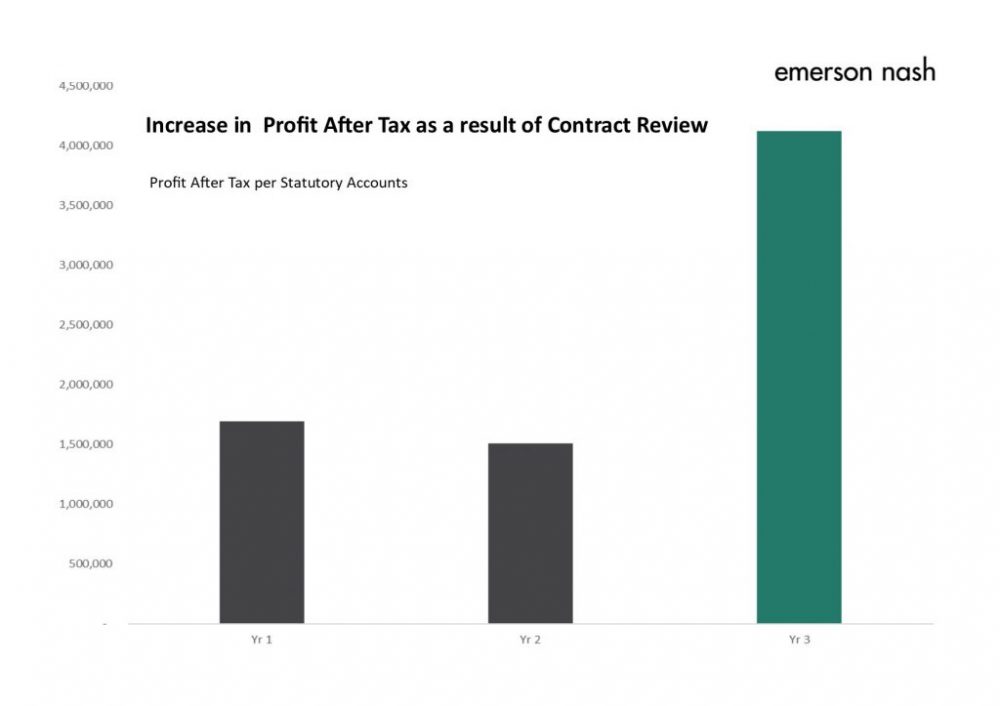

Taking advantage of the allowances on offer, we generated over £5m in historical profits that had not been taken by the business. We also provided surety on the likely tax liabilities.

The business was also able to realise over £1m per year in additional profits for the following two years. This increased the profitability of the business substantially.

The management team were delighted, and the owners were able to pay themselves substantial bonuses. The owners were delighted as a result.

Return on Investment (ROI)

|

|

Value created |

Return multiple |

|

Return over 1 year |

£5,000,000+ |

Over 10 times |

|

Return over 3 years |

£7,000,000+ |

Over 15 times |

We measure the return on investment as the ratio of what value the client receives compared to their investment with us.

About the Business

-

Mid-sized international business

-

Multiple large contracts to provide services in a variety of international countries

-

Wide range of customers from blue chip corporates to mid-sized business

-

Sales of circa £130m and Profits After Tax of below £1.5m per year